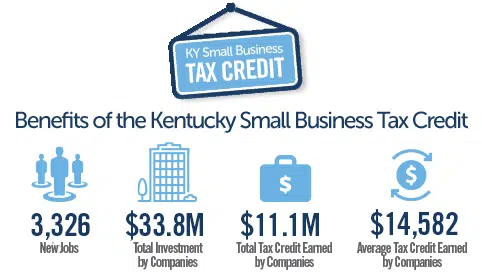

Kentucky House Bill 8 has expanded the sales and use tax base to include a number of new services effective January 1, 2023. Some of the new services added include photography and photo finishing services, marketing services, and personal fitness training services. With these changes in legislation your company may be eligible for a substantial tax credit. The Kentucky Small Business Tax Credit Program offers between $3,500 and $25,000 per year. To qualify for this program your business must have hired and sustained at least one new job in the last year and purchased at least $5,000 in qualifying equipment or technology.

Things to Know

- Most for-profit businesses with 50 or

fewer full-time employees are eligible - The tax credit is available to all businesses

including retail, service, construction,

manufacturing and wholesale - The tax credit applies to the state tax

return for the year it was awarded, with

a five year carry forward - To qualify, there are specific

requirements for wages paid and hours

worked - The position(s) must be newly created

and additions to your existing workforce - Examples of qualifying equipment

and technology include computers,

equipment, furniture, fixtures, furnishings

(excluding artwork) and vehicles titled in

the legal name of the business, etc.

More information on requirements, guidelines, and an application form here: Kentucky Cabinet for Economic Development